Let’s say I tossed a quarter and the first three coin tosses came up as heads. What would your guess for the next coin toss?

What if the next one was heads as well? Then what would you guess?

We all know that coin tosses are random, and that the outcome of one coin toss (or a series of prior coin tosses) has no influence on the outcome of the next toss. But the brain subconsciously will have us factor in past outcomes when guessing the next one. Some may say, “we’re on a roll” while others say, “we’re due for a change”.

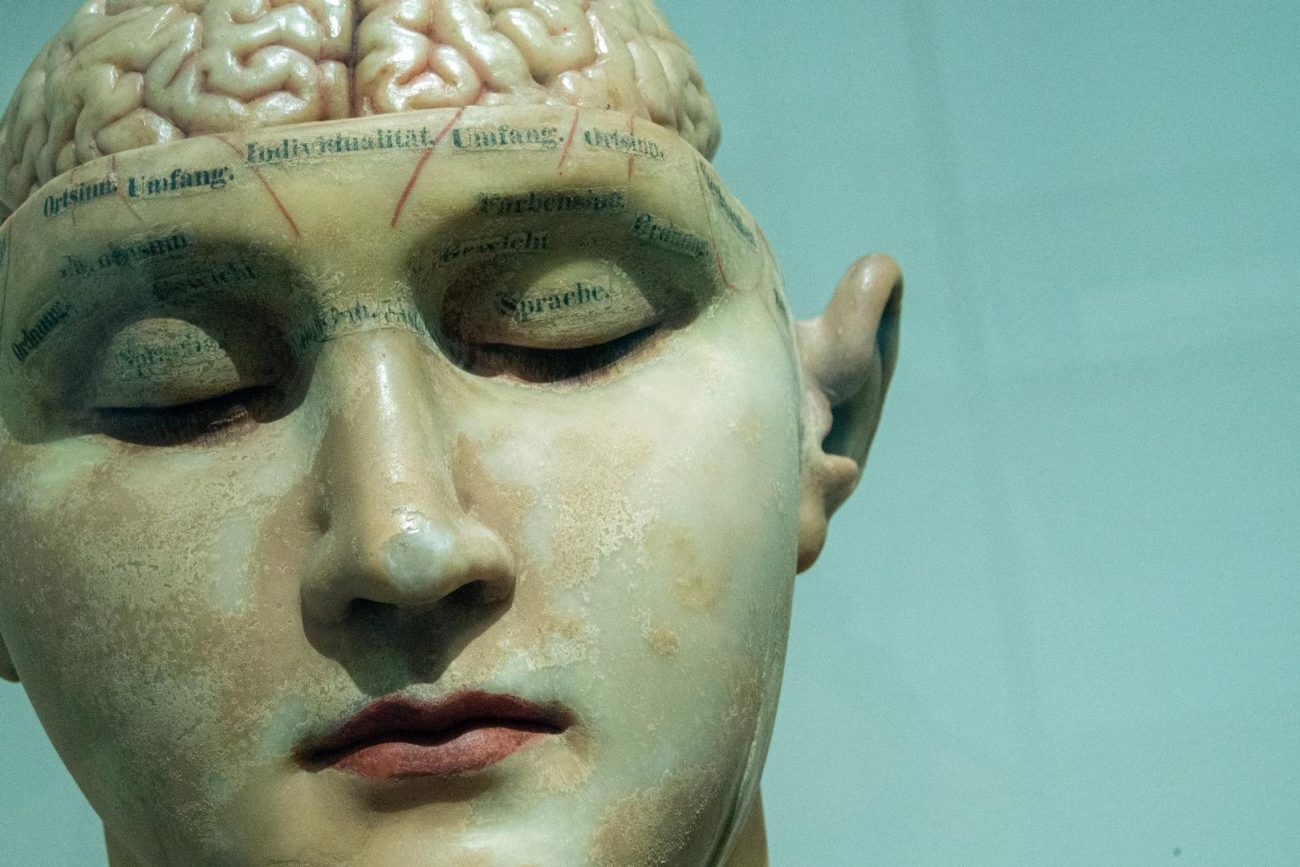

Our brain is a pattern-detecting machine and will influence our opinions of the future based on prior patterns it has detected. The brain is so good at this, it can even detect patterns among randomness (such as a series of coin tosses).

This hardwiring helps us be very efficient in life but can sometimes cause us to err – especially when making financial decisions.

Today, many investors may be tempted to say, “the market is due to go down” and proactively adjust their portfolio based on that outlook. Statistically speaking you may be correct, but statistics only work over very long periods of time.

The natural instinct is to make decisions based on past outcomes and patterns. But when it comes to investing, that can be very costly. The investor that was certain we were due for a change after a nine-year bull market would have missed significant gains in 2019.

The past is not a predictor of the future, no matter how much our pattern-detecting brain tells us it can be. That is why it is crucial to make financial decisions based upon your financial plan and not instinct or feeling.

Joanna Amberger

Joanna Amberger

CERTIFIED FINANCIAL PLANNER™

3 Financial Group

1888 Kalakaua Avenue, Suite C312

Honolulu, HI 96815

808.791.2925

www.3FinancialGroup.com

©2020. The Behavioral Finance Network. Used with permission