Taking control of your finances becomes more and more important as you grow older. They don’t teach financial planning in your 20s, in high school, or in college. Most young adults leave school and are missing a key part of their education: financial planning. That’s why it’s so important to take steps to educate yourself on how to become financially independent, how to budget, and how to invest – to name a few. Young adults may be clueless about how to manage money, stay out of debt, or apply for credit…but that doesn’t mean you can’t take matters into your own hands and learn about it now.

Learning how to budget and manage money is an important part of long-term financial success. But understanding the complexities tends to be more difficult for women and LGBTQ+ youth, who may be battling stigma, or who may have different priorities in life. A lot of financial literature on the internet really doesn’t take into account these shifting needs. Keep reading to learn about our 9 key financial planning tips for young adults in their 20s and 30s.

9 Financial Planning Tips for Young Adults

1. Be aware of your spending

Do you understand how you spend money? One of the first steps to successful financial planning is understanding the ways in which your money is spent month-to-month. Do you spend $10 at Starbucks each day? Are movies each weekend your big indulgence? Does eating out each workday really drain your budget?

There’s a good chance you may not be aware of how you spend your money. In this day and age, we just tap our credit cards and move on.

With a bird’s eye view of your spending each month, you can break down your expenditures and make strategic changes to control your spending habits. You can also use apps like Mint and their budgeting tools to get a better picture of your spending as well. If budgeting tools sound like they might help you, be sure to also check out YNAB (which stands for You Need a Budget), EveryDollar, PocketGuard, and GoodBudget, which all come highly recommended. Don’t get too bogged down in picking the “right” too. What is most important is understanding how you spend your money so you can make choices that are in line with your values.

Once you understand how you spend your money, you can make better decisions. Ideally, you want to first understand your values and what is important to you in life. If you have been spending in the past without a plan, you might find that your spending patterns really don’t support your values. For example, if you value free time with your family, are you spending your money in a way that supports that? Or, are you spending your money in a way that makes it more difficult for you to get that free time you value?

Of course, if you are in debt, the first thing you may need to pay attention to is how to stop spending more than you earn. By looking at your spending patterns you can start to make shifts in your behavior so you aren’t digging a deeper debt hole every month. The changes you might need to make can be small. For example, would you be better off bringing leftovers to work? Can you skip that morning coffee? Instead of going out to the movies, get a streaming subscription and enjoy movie nights at home. These are the types of small changes that can help set you up, financially, for the future. As in many other areas of financial planning, small changes can really add up over time.

2. Set life goals

What does financial freedom mean to you? Everyone wants financial freedom, but that’s too vague of a goal for you and your financial life. To set yourself up for financial success, you need to think more specific. First, think about the vision of what you want in your life and then start to put numbers and details to that vision. Consider big goals then quantities, and deadlines.

For example: do you want to buy a house by 30? What do you see yourself doing in retirement? Do you want to move out of your family’s home? Are you planning a big solo trip around the world? The more specific your goals, the better you can save for them.

Start with these objectives:

- What does your lifestyle require? Think: Are you living with a partner, or are you living alone? Do your parents support you? Do you have upcoming expenditures coming up, like an IUD or any other health procedures?

- How much will your goals cost you?

- How much money do you need in your bank or investment accounts to make your day-to-day life possible?

- What big financial goals do you have coming up?

- When do you want to achieve these goals?

Once you have a deadline, you can count backwards and set financial milestones at regular intervals to make it all seem more manageable. Breaking big goals into smaller pieces makes it much easier and more manageable to reach the big goal. You can see yourself hitting the small goals and celebrate your success!

3. Don’t be afraid of investing

Volatile stock markets can make people question whether or not they want to invest their money. But it’s important to remember that historically, there’s no better way to grow your money. You want your money working hard for you, not just sitting around in the bank doing nothing! There’s only one caveat: you need time to achieve meaningful goals.

How old do you have to be to invest? Now! The earlier, the better.

If you want to start off easy, consider investing in mutual funds or ETFs that are all-in-one funds based on your risk tolerance. Lack of financial literacy on investment is oftentimes one of the biggest hurdles when it comes to getting started, especially when it comes to financial planning for women. Women aren’t typically taught about investing or stocks, and as a result, they usually feel confused and intimidated by the very idea of investing. That’s perfectly normal! Just know that there are resources out there, and we can help you as well!

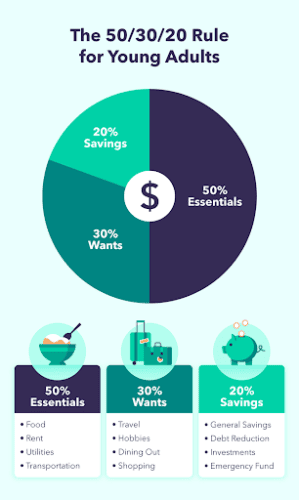

4. Adopt the 50/30/20 Rule

The 50/30/20 rule is used by many people who try to align savings goals with their spending habits. If you haven’t heard of this rule, don’t worry. Here’s how it works. After taxes, pool your income into three categories: essentials, wants, and savings.

Fifty percent of your money will go toward essentials. That means bills, housing, food, transportation, etc.

Thirty percent is used to fulfill your wants. That means things like daily coffee runs, travel, and more.

The remaining 20% will go to your savings. Ideally, you should worry about this after you have paid your bills – but before you start your discretionary spending. That will allow you to spend knowing you have taken care of your responsibilities for the month.

Individuals in the LGBTQ community also face unique challenges that aren’t met by a typical budget. That’s why we have an entire blog post to help you address the goals, decisions, and needs that a “traditional” family may not have.

5. Avoid high-risk personal loans and credit cards

Credit cards and other high-interest loans can be toxic to wealth building, especially at a young age. If you do opt for these, make sure to pay off the full balance each month.

Other personal loans like student loans, mortgages, and similar loans will tend to have much lower interest rates. It’s not always possible to pay these off at once, but it’s still important to make on-time payments to keep up your credit score.

Be careful with the Buy Now Pay Later (BNPL) programs and apps that are becoming more popular. This is nothing new, just marketed in a modern way. Ask your parents or grandparents about lay-away! BNPL works like a credit card but they have a few small differences that can really add up. The biggest issue with BNPL is that it encourages you to overspend. Breaking your purchases into smaller payments makes it much easier for you to spend more than you have. For example, instead of seeing an item for sale at $100, you might be offered the option to only have to pay $10 or $25 a month. This can make the item feel much more affordable. That might work for a single purchase, but retailers know that this ultimately leads most people to buy more and more because each purchase by itself has a smaller value. But add all those together and you can wind up paying a lot, especially when you add fees and interest to the mix.

6. Start saving for retirement

The earlier you start to save for retirement, the better. Compound interest can be difficult to fully explain, but the important takeaway is that the sooner you save, the less money you will need to invest to reach the amount needed for retirement. If you start investing in your 20s, your money will go much, much further than if you started in your mid-30s. This concept is even more important if you plan to retire early. In the words of Albert Einstein: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”.

7. Start an emergency fund

“Emergency fund” sounds really…adult. But hear us out: it’s crucial. Prioritizing your financial stability means establishing an emergency fund. Regardless of your salary or debt, it’s still crucial to always put away a portion of your income for an unexpected event.

Here’s a general rule of thumb: try and save around three to six months’ worth of living expenses for your rainy day fund. You will be able to sleep much easier if you know you can face any potential financial troubles that may come your way.

There’s a second part to this as well: you need to treat your emergency fund as a non-negotiable expense, and one bucket that you cannot touch. Don’t set up an emergency fund just to raid it every month because you continually overspend.

8. Don’t feel guilty

Perhaps the most difficult part about saving money? The guilt. You may not be able to fully participate in activities your friends or colleagues are participating in, like going out to eat for lunch each day or drinking at bars and clubs through the weekend. It’s crucial to remember that you shouldn’t feel guilty for saving money. It’s an important part of your future, and will allow you to do many things (either now or down the line) that you otherwise wouldn’t be able to do, like traveling, buying a house, or attending college. Life is full of choices. Be sure to make your choices based on what you value as opposed to comparing yourself to people around you. If you value eating out or going to clubs, there is nothing wrong with that. But just be clear with yourself that decisions to spend your money on one activity or purchase means you limit your choices in other areas. Also, don’t be fooled by the spending you see around you. Many people live lavish lifestyles well beyond their means. In the end, it’s not about how much money you make, but how much you keep.

9. Speak with a financial advisor

There’s no shame in not knowing it all. Sometimes, your own situation can be difficult or confusing to figure out. Just because you see someone else succeeding doesn’t mean they didn’t get help – so don’t be afraid to get help, too, if you need it. Oftentimes, people look to financial advisors when they have a lot of money or they went through financial hardship – and need guidance. But the truth is that you can speak to financial advisors to be proactive as well, especially when it comes to investing. A financial advisor can help guide you to set goals, create a budget, and more. Our job is to help you build a future.

Key Takeaways: Financial Planning for Young Adults

There’s no better time than the present to take control of your spending habits and build a spending plan. Setting yourself up for financial success doesn’t require a math degree or any professional qualifications. Saving earlier in life and understanding your own values and financial goals gives you a big advantage for the future. If you follow our easy tips, you’ll feel confident when building your financial future. And remember, if you need help, don’t be afraid to ask!