Question: I’ve heard that many CEOs are predicting a US recession right now. Is there anything that we can do to mitigate damage?

Answer:

I think there are two parts to your question:

- Are we entering a recession?

- Does it matter for my investments?

The first question is unclear. There are many different ways people define recessions, and there are political reasons why one side or the other would want to claim a recession is happening (or not), but the National Bureau of Economic Research (NBER) is the official arbiter of the start and end dates of US recessions. The media likes to grab onto easy numbers because the media is not very good at complex analysis and soundbites do not lend themselves to such complexity. Unlike the media, who merely use GDP as the benchmark for a recession, the NBER has a much broader definition that is harder to put into a soundbite: a significant decline in economic activity that is spread across the economy and that lasts more than a few months. This article has a good analysis of different indicators that might tell us whether we are headed that way or not. Some of the reasons we might not be headed for a recession include a strong labor market, corporations sitting on a lot of cash and maintaining profits, and the Federal Reserve continuing to raise rates to combat inflation. We often won’t know it was a recession until we have the benefit of hindsight to verify it.

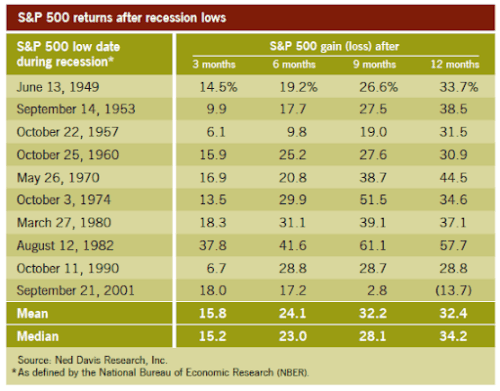

The second question is a little easier to answer: No, it does not matter to your investments over the long term if we are in a recession. While trying to predict economic conditions may be valuable for businesses who are deciding if they should invest in labor, or expand capacity, or enter new markets, for example, trying to use those predictions for investments is notoriously difficult, if not impossible. When we look at the history of the stock market as represented by the S&P 500, we see that markets are very resilient. While the past does not guarantee the future, the past does provide us with the best information we have to make decisions about an unknown future. And the past shows us that the market is almost always in positive territory within months of the low part of a recession. When the market declines, prices are low, and that is the best time to be buying so we’re positioned for the upswing.

Most people want to react to market volatility when the prices of their investments have already dropped, which is the exact wrong time to be selling. Most people also want to wait to invest until the market feels “safe” but this means they are waiting until prices have already risen before jumping back in. This puts people on the cycle of selling low and buying high. The media loves to produce stories with useless data and information which make us feel like we need to DO something. But what do we do? I saw an article that suggested the following investment strategy: if the economy recovers swiftly, you want to “bet on beaten-down growth and tech stocks”. But, if the economy keeps dipping, investors may want to “take refuge in asset-backed defensive stocks like healthcare companies and real estate investment trusts.” That is a bunch of nonsensical, noncommittal garbage that provides no real solution, but makes the author look smart by being able to provide a forecast that cannot be wrong because it hedges both sides.

Also, I would like to point out that the author uses the word “bet” for this strategy. We are not betting on anything when we are investing in stocks. Why do we invest? Because we believe that companies create real value through the products and services they produce. As an investor, we are an owner of the company, and our ownership is rewarded by the profits (dividends) that are returned to owners and our ability to sell our ownership share for more than we bought it for. As an owner, what we really care about is the long-term profitability of our company, not the short-term price fluctuations that are caused by other people’s random predictions.

In the short term, there really is no safe haven right now. Cash is getting eaten alive by inflation, bond prices are getting hammered by the rising interest rates, and stocks are volatile for many reasons including COVID ripple effects, Ukraine, and general skittishness over any increase in interest rates. Real estate markets are seeing prices decline with the rise in interest rates. But I could have said the same thing 10, 20, or 30 years ago, with slightly different underlying reasons.

Our strategy is boring by media standards. We don’t react to bad news. We use a long-term strategy of managing risk through asset allocation and diversification. We invest consistently so we can take advantage of buying opportunities and not miss out on unpredictable gains. We pay attention to taxes and internal costs. And, we try to help our clients make good decisions. Because ultimately, the most important element in a financial plan is the decisions you make. Not the investments. Your decisions. Bad or misinformed decisions can burn a sound investment plan to the ground.