The Importance of Rebalancing Your Investment Portfolio

What is Rebalancing?

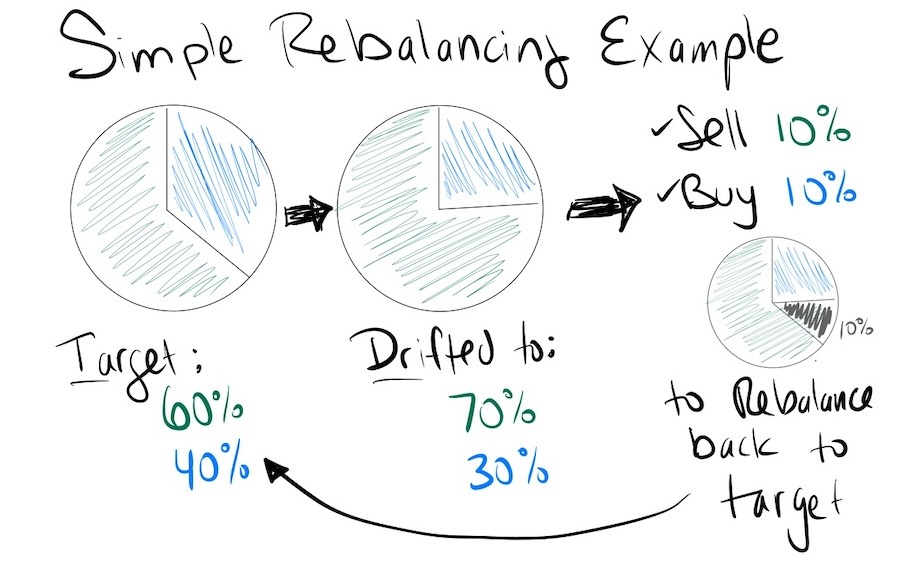

Rebalancing an investment portfolio involves realigning the weightings of a portfolio’s assets to maintain a desired level of risk and return. Over time, the value of various investments within the portfolio can drift due to market performance. For instance, if stocks outperform bonds, your portfolio may become more heavily weighted in stocks than initially intended. That can make your portfolio riskier than you want it to be. Rebalancing brings your portfolio back to its original asset allocation targets by buying or selling assets.

Why is Rebalancing Important?

Risk Management: Maintaining your target asset allocation helps control risk. If your portfolio becomes too heavily weighted in stocks during a bull market, for example, it may be more vulnerable to a downturn. Rebalancing helps manage this risk by ensuring your portfolio remains aligned with your risk tolerance and investment goals.

Disciplined Approach: Rebalancing enforces a disciplined investment strategy. It helps avoid emotional decision-making, such as buying high during market peaks or selling low during downturns. By adhering to a rebalancing plan, you can maintain a consistent investment approach.

Optimized Returns: Rebalancing can enhance long-term returns by ensuring that you systematically take profits from high-performing assets and reinvest them in underperforming ones. This “buy low, sell high” approach can help smooth out returns and potentially improve performance over time.

How Often Should You Rebalance Your Portfolio?

Using a time-based rebalancing strategy, such as quarterly rebalancing, can sometimes cut off momentum too soon.[i] This means you might prematurely buy or sell an asset. A more effective approach is to use relative tolerance bands, which set thresholds for how much an asset class can deviate from its target allocation before rebalancing is triggered.[ii] For example, if one asset target in your portfolio is 50% and your tolerance is 20%, you would only rebalance if the amount of that asset in your portfolio moved below 40% or above 60%. Once you have set your tolerance band, you need to regularly review your portfolio to determine when it goes outside of your acceptable range. Not reviewing your portfolio often enough can lead to missed opportunities.

How to Rebalance Your Portfolio

Manual Rebalancing: DIY Consumers often need to manually calculate and trade their portfolios to rebalance. This involves assessing current asset allocations against targets and rebalance thresholds, determining the necessary trades to restore target allocations, and executing these trades. This process can be time-consuming and requires regular monitoring to ensure opportunities aren’t missed. Ideally you should be reviewing your portfolio for rebalancing opportunities every two weeks.

Automatic Rebalancing Options: Many employer-sponsored retirement plans offer automatic rebalancing features. These services periodically adjust your portfolio back to its target allocation without any manual intervention required. This can be a convenient option for those who prefer a hands-off approach.

Work with a full-service advisor: Partnering with a full-service financial advisor can simplify the rebalancing process. As a full-service advisor, 3 Financial Group handles the logistics of rebalancing, ensuring your portfolio remains aligned with your goals and risk tolerance. By leveraging our expertise and regular portfolio reviews, you can focus on your life while knowing your investments are in good hands.

Key Takeaways

Rebalancing is a vital aspect of maintaining a healthy investment portfolio. It helps manage risk, enforce discipline, and optimize returns. Whether you choose to rebalance manually, utilize automatic options, or work with a financial advisor, the key is to ensure it is done regularly and effectively. As a CERTIFIED FINANCIAL PLANNER™ professional, I am here to provide the expertise and support needed to keep your portfolio on track. Reach out to discuss how we can optimize your investment strategy and achieve your financial goals together.

[i] Jaconetti, C. M., Kinniry Jr., F. M., & Zilbering, Y. (2010). Best practices for portfolio rebalancing.

[ii] Daryanani, G. (2008). Opportunistic Rebalancing: A New Paradigm for Wealth Managers.

#COD00000359/Aug2024