Planning for retirement when you’re self-employed can be a big challenge. Instead of simply selecting one of the few plans your employer chooses, you’re now on your own to plan the path to the retirement that you want. The options are more varied, and you’re the only one in charge.

That’s why we’ve created this comprehensive guide to retirement plans for self-employed people. You’ll learn about the most popular available options and how to choose the plan that’s right for you. Let’s get going!

Planning for Retirement When You’re Self-Employed

While retirement planning might seem like a far-off dream when you’re self-employed, it’s important to focus on. Since you don’t have an employer providing retirement plan options, or even opting you into a retirement plan automatically, you need to plan for your future on your own.

The first step is figuring out how much you need to save for retirement. This won’t be an exact figure, but you should have a ballpark range for retirement based on your current expenses and cash flow. You can use one of the many online calculators to estimate your financial needs in retirement based on when you plan to retire and your retirement plans[JA1] . Better yet, you can work with a Certified Financial Planner® for a more accurate and complete picture of when you would like to retire, what you need to achieve in order to retire by that date, and what standard of living you will be able to sustain in retirement based on various savings goals.

Traditional or Roth IRAs

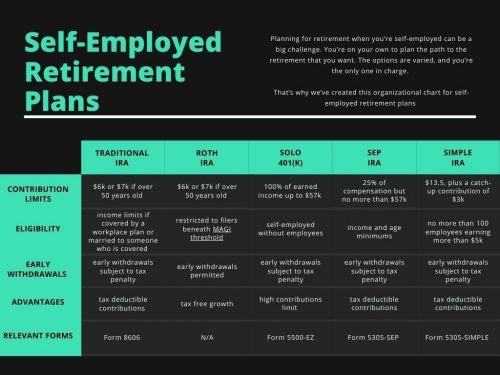

Traditional and Roth IRA contributions are capped at $6,000 in 2021 and $7,000 if you’re over age 50.

Some contributions to a traditional IRA can be tax deductible, which can help lower your current tax burden. You will pay taxes when you withdraw the money in retirement, however.

Roth IRAs can be a great option for anyone who thinks their tax burden will rise in future years – maybe you’ve just started out in the self-employment world. You don’t get a tax break for your contributions to a Roth IRA now, but you won’t have to pay taxes on your withdrawals in retirement.

Solo 401(k)

Solo 401(k)s, also known as one participant 401(ks) are best for business owners or people who are self-employed and don’t have employees. You can contribute much more to these kinds of plans than to an IRA: $57,000 or 100% of earned income, whichever is lower. These plans work just like employer 401(k) plans, except you fund them yourself. You can contribute both in your capacity as an employer (up to 25% of compensation) and employee (up to 100% of your compensation or $19,500, whichever is less).

These kinds of plans are great for self-employed people who want to save a lot of money for retirement in good years, but don’t want to commit to certain savings levels ahead of time in case future years are leaner.

SEP IRA

SEP IRA options are also best for self-employed people with no or few employees. You can contribute the lesser of $57,000 or up to 25% of compensation or net self-employment earnings. You can deduct the lesser of your contributions or 25% of net self-employment earnings or compensation on your taxes, and distributions in retirement are taxed as income.

One important thing to note about this option if you have employees is that you need to contribute an equal percentage of salary for each eligible employee. You’re counted as an employee as well, even as the owner. So if you contribute 10% of your compensation for yourself, you must contribute 10% of each eligible employee’s compensation as well.

SIMPLE IRA

Bigger businesses with up to 100 employees benefit from SIMPLE IRA plans. You can contribute up to $13,500, plus a catch-up contribution of $3,000 if you’re 50 or older. Contributions are tax-deductible, but distributions in retirement are taxed as income.

Employees can contribute themselves, but employers generally need to match those contributions up to 3% of compensation or 2% to every eligible employee[JA1] . A financial advisor like Honolulu’s 3 Financial can help you open a SIMPLE IRA and start meeting your retirement goals.

Defined Benefit Plan

A defined benefit plan is great for self-employed people who don’t have any employees and do have a high income level. This is basically a pension plan for self-employed people. Your contributions are based on the benefit you’ll receive at retirement, your age, and the expected return on your investment. You need to get an actuary to figure your deduction limit. Your contributions are typically tax-deductible and your distributions in retirement are taxed like income.

These plans are great ways to save a lot of money for self-employed people, but they’re also expensive to set up and have high annual fees. You’re also committed to funding your plan with a certain amount every year, regardless of your business results. But if you want to save $50,000 to $80,000 each year or more for your retirement, a defined benefit plan might be right for you.

Key Takeaways

There are multiple options available for today’s self-employed professionals. Whether you’re just starting out with saving for retirement or want to stash a lot of cash away every year for your future, you can find the choice that’s right for you. A financial planner can help you consider all the options, and a fee-based financial planner can help you make the choice that’s right for you and your business.

At 3 Financial in Honolulu, we have years of experience helping small business owners navigate the personal, business, and tax consequences of self-employed retirement plans. We understand that what’s at stake is our clients’ ability to retire comfortably without worrying about whether they’ll have enough income to last throughout retirement.

Get the right financial help and guidance to pick a plan with the maximum benefit and minimum risk for you and your business by contacting us today.

Disclosure: 3 Financial Group and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied upon for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.