Most outcomes in life are a culmination of both skill and luck (or bad luck). How much an outcome is influenced by skill versus luck differs among activities. Basketball is dominated by skill…typically you see the best teams win. Roulette is dominated by luck. What about investing?

Skill and Luck with Investing

Skill is absolutely a factor with investment results, but we often underestimate the role of luck. Luck, good or bad, can play a significant part in investment results. And the shorter the time horizon, the more luck is likely to influence results.

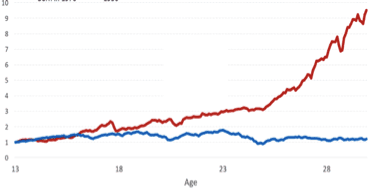

Take a look at the chart below, which tracks performance of two individuals investing from age 13 to 30. What caused significant difference in performance?

Source: Morgan Housel

It wasn’t the investments. They were both the S&P 500. The difference is when they were born. The red line represents someone born in 1970. The blue line, 1950.

Improving Investor Skills

What sets successful investors apart from the rest, according to Warren Buffett, is the ability to control the urges. In other words, investing success has more to do with our behavior (decisions and reactions) than it does with our intelligence.

We can improve our investing skills by working on our decision-making process. Surgeons, pilots and the military set rules and checklists to define their exact actions before they are needed. Most investors don’t, preferring to respond in the moment (when emotions are high).

I am here to help you define investment rules that fit your circumstances. And I am here to help you abide by those rules…understanding that is not an easy task when emotions are high.

(c) 2018 The Behavioral Finance Network. Used with permission.