3 Ways to Practice Strategic Financial Ignorance

What would happen if you went into hibernation last spring, and only just woke up now? What would you have missed?

As an investor, you probably would have slept through several months of market volatility.

Months may have passed with the following news headlines:

“Crashes Ahead for the Stock Market.”

“Stock Market Gives Back Some Loss.”

“Stock Market Today: Dow Drops After Powell Says the Fed Is Prepared to Raise Rates Even More Aggressively.”

Closely watching months and months of these headlines can leave investors like you feeling drained, anxious, and confused. Should I pull out of the market? Should I stick around and take the losses? It’s completely normal to be having these thoughts – in times of volatility, many of our clients are asking us similar questions. These thoughts only become an issue when investors succumb to their emotions and make investing decisions based on fear instead of logic.

So, if you’re someone with a lot of anxiety and fear around fluctuations in your investments, how can you handle this? That’s where strategic ignorance comes in. Practicing strategic ignorance is about selecting which information you pay attention to, and which information to ignore. Strategic ignorance, when executed responsibly, can be a helpful tool for reducing anxiety around your finances.

The truth is that not all information out there is beneficial to us. We need to be selective in what we pay attention to. It’s crucial to ignore that which is detrimental to making thoughtful decisions and rely on your plan to be your guide.

What is strategic ignorance?

You’ve likely heard the saying, “Ignorance is bliss.” By selectively and strategically ignoring certain pieces of information (as long as this avoidance doesn’t actively harm us), we can achieve peace of mind that we wouldn’t otherwise have. Strategic ignorance is essentially purposeful information aversion.

The key to strategic ignorance is to ignore certain pieces of information if they might not be helpful to us. However, it’s important to not ignore unpleasant or scary information because this can be more harmful in the long run.

When used correctly, strategic ignorance can be highly beneficial to your financial and mental health. Take stock market volatility as an example. The stock market has historically experienced a lot of volatility – and will continue to do so. It’s not unusual for the stock market to fluctuate up and down, even outside of big crashes, like the Black Monday crash of 1987 or the 2008 housing market crash, for example.

However, it’s even more important to remember that the stock market has always bounced back. If you’re investing for long-term success, you might try to exercise strategic ignorance when reading the news (“More Crashes Ahead For The Stock Market” headlines, for example) and instead looking at the bigger picture: the stock market will likely bounce back.

How can you practice strategic financial ignorance?

Investing, in the long term, isn’t always about looking at the short term market fluctuations. Here’s how you can practice strategic financial ignorance.

1. Remember the bigger picture

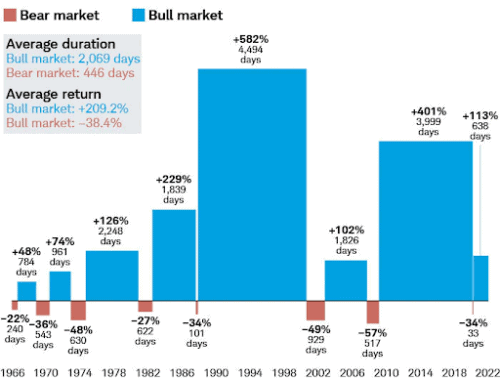

Remember, markets go up and down over history. During your lifetime, you will likely see several significant drops and several significant gains. But even big market drops are relatively short compared to the big increases seen in the following days.

It’s nearly impossible to time the market’s ups and downs. Smart investors will opt to ignore the noise and stay focused on their long-term goals.

Photo courtesy of Charles Schwab

2. Resist the urge to act

Recent stock market movements may leave you feeling nervous and anxious. During market volatility, resist the urge to act on your emotions. Selling stocks when the market drops can make your losses more permanent.

Staying the course and keeping your money in the market may be difficult emotionally, but it typically provides a long-term healthier portfolio. Looking at your investment’s future prospects can help add logic and reason into the equation, and remove the emotion from the decision making process.

If you do want to sell, consider consulting with your financial advisor first. A good financial advisor can help you decide whether you should hold onto an investment, or move on.

3. Don’t be afraid to look at your bank accounts

Many of our clients come to us and say, “I’m too nervous to look at my bank accounts.” It is completely normal to feel this way.

Our advice? If frequently checking your accounts gives you unnecessary stress and anxiety, don’t be afraid to reduce this frequency. Establish a cadence that works for you and your unique financial plan. If you have a well thought out long-term plan, you should be able to trust the process and know that although the market will go through those inevitable ups and downs, your wealth will still continue to grow overtime.

When periods of volatility do come, we stick to our plan and we trust our plan. Strategically ignoring that short-term noise, like rocky monthly statements, can be beneficial to your financial health – and your emotional health.

Takeaways

At the end of the day, it can be difficult to ignore the fear-mongering news headlines and anxiety-inducing stories about the stock market. Keep in mind that not all information is beneficial to you as an investor – you simply have to sift through the noise and trust your financial plan.

What can you do to safeguard yourself from making rash financial decisions? First, make sure to consult with your financial advisor. At 3 Financial Group, we can help you practice strategic ignorance, and help you better understand which advice is helpful to you – and which advice is harmful.

Contact us today and connect with us on social to join the conversation!