Answers by Joanna: Gold & Silver

Q: Do you think now is a good time to invest in gold and silver?

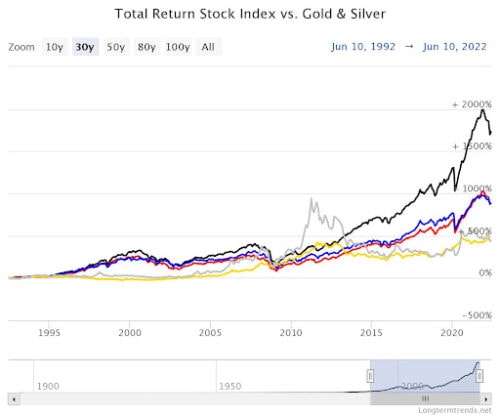

A: Gold and silver have periods of big spikes when people get worried about the market. When the market gets volatile, you see a lot of advertisements on TV, in print and online to buy precious metals. BUT, gold and silver over time tends to be a lackluster performer. I am attaching a chart that shows long term performance of three stock indices compared to silver and gold. There was a brief period following the 2009 housing crisis when gold outperformed the stock market, but since then has lost a lot of ground to stocks. Looking at the 200 year history of gold from 1802-2001, gold actually lost money. A dollar invested in 1802 would be worth only 98 cents in 2001!

One problem with gold is that it relies exclusively on price appreciation. It pays no dividends or interest and produces no goods or services. Gold also requires cash outlays for storage and insurance while not providing any cashflow until sale. This can create a phenomenon called “negative carry.” But even just comparing the price returns of gold, silver and two stock indices (S&P 500 an Dow Jones Industry Average), gold and silver generally underperform over long periods of time.

In contrast, stock returns are both dividends (return of profits) and price appreciation (capital gains). In the attached chart you can see the Wilshire Large-Cap index that shows cash payouts such as dividends reinvested back in the fund. You can really see the power of reinvested dividends in this example. The companies you own through stocks create goods and services that consumers purchase. When we look at the volatility of gold prices compared to stock prices, generally we see gold has similar (if not higher) volatility and lower returns – not a good tradeoff. I took gold out of my clients’ portfolios several years ago because it was not adding value, but just driving up volatility. If you do want to invest in gold, I would advise putting no more than 5% of your total portfolio value into it. Generally, when we diversify, the target is to keep any individual holding at 5% or less.

Source: Longtermtrends.net: In contrast to the S&P 500 Price Index and the Dow Jones , the Wilshire Large-Cap is a total return index, in which all resulting cash payouts (including dividends) are automatically reinvested back into the fund itself. Therefore, it includes all capital gains and it allows for an accurate performance comparison with Gold and Silver.