Answers by Joanna: Recession and Stock Market Performance

I’ve been asked recently about an inevitable recession and stock market performance. My answer to this question is broken down into two components:

Q: Do we know if we are going into recession?

Recessions are notoriously difficult to predict and part of the issue is that there isn’t really a standard definition of a recession. Economist Julius Shiskin developed a simple rule of thumb that says a recession is two consecutive quarters of declining GDP. The National Bureau of Economic Research defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.” Because the definition of a recession is backward looking, we don’t really know if we are in one until after it has already started. Economists and pundits LOVE to predict recessions, but are generally terrible at it! Forecasters tend to be too optimistic about forecasting growth and slow to predict or identify recessions.

Q: How do stocks perform during a recession?

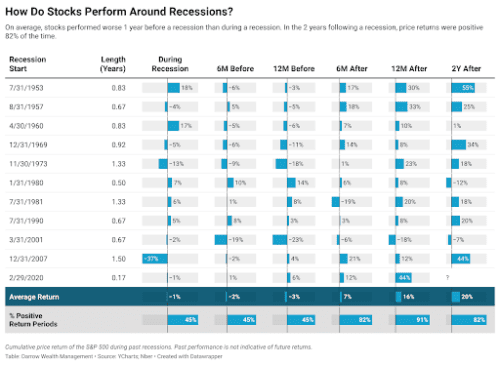

The stock market tends to perform poorly before and during a recession, but in just barely more than half of the cases. In 45% of the recessions since 1953, the stock market has returned positive rates of return. Looking to after recession periods, we see a much stronger trend for the market to return to positive returns (91% 1 year after and 82% 2 years after). I’m attaching a chart that shows each recession since 1953 for reference. Taking this with the previous point, the market has already declined by the time a recession is upon us, so trying to get out of the way when it has already hit is too late.

Takeaways:

Recessions are a normal part of the business cycle. Trying to time the market typically leads to making emotional decisions at the wrong time. And most people are terrible at it! Usually when people try to time the market they buy high and sell low. They lock in losses after the market has already declined and wait until the coast is clear and prices have gone back up before buying back into the market. That is a great way to erode the value of a portfolio. Instead of trying to guess what is going to happen in the future, we prepare in advance using asset allocation and diversification as our key strategies to manage risk. This does not mean your portfolio will never decline in value, but we try to mitigate the bumps along the way and spread risk out over many different investments. Of course it isn’t easy to watch your portfolio go down at any time, but I encourage you to remember the long term plan. Also, turn off the news and ignore the media pundits! They are there to prey on your fear and greed to make money from your eyeballs on advertisements.